Enrollment in Fulfillment by Amazon (FBA) provides access to a wide-spread, efficient fulfillment network to brands and manufacturers. By using FBA, Amazon businesses gain access to over 150 million Prime members by making their products eligible for 2-day Prime fulfillment. Although the benefits of FBA are attractive to both small and large businesses, it is very important for Sellers to understand the fees and costs associated with using the platform. There are three main categories of costs to consider when utilizing FBA: the cost of shipping inventory to FBA, FBA Storage fees, and FBA Order Fulfillment fees.

When using fulfillment by Amazon it is important to have an idea of what is going on behind the scenes so you know how much it will cost. For the purpose of this post, we are going to break the fees down in terms of shipping the product into Amazon's Warehouse. What is charged while the item is at Amazon's warehouse and what the costs are for Amazon to ship your product to the end customer. Amazon adjusts the costs of these FBA fees on generally an annual basis so it is important to review Amazon’s cost structure on the Seller Central terms.

Estimate Cost to Ship Products to Amazon’s Fulfillment Centers

When sending inventory to Amazon, sellers must pay a shipping carrier to have their products transported to Amazon’s fulfillment center network. Unlike the other FBA-related fees, these fees are non-standardized and differ on a case-by-case basis. There are a few different factors that can affect the cost to ship products to Amazon’s fulfillment centers:

Weight and dimensions of the product

Quantity of product

Quantity of boxes/pallets

Packaging style (individual boxes vs. pallets)

Distance to the fulfillment center

Sellers can take advantage of the Amazon Partnered Carrier program that offers discounted shipping rates that are very competitive compared to third-party shipping companies. This program is available for small parcel delivers (SPDs), less-than-truckload (LTL), and full-truckload (FTL) shipments. Under this shipping program, billable weight is the primary factor in determining shipping costs. Please note, that this program is not available for Dangerous Goods, and they must be shipped through a third-party shipping company.

How to Calculate Amazon FBA Fulfillment Fees

General FBA Shipping Fee Structure

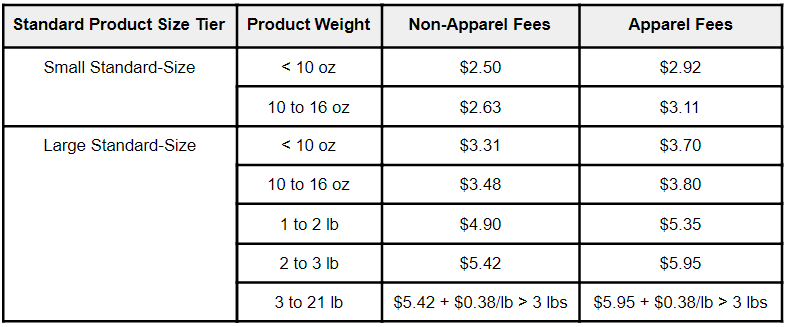

The primary factors in determining per unit FBA fees are the dimensions and weight of the product being sold. Amazon utilizes a tiered pricing system to designate a per-unit fee on your inventory. When you add a product to Amazon, it will be classified into one of 3 main categories. Based on the dimensions and weight of your product, it will be classified as one of the following product sizes:

Small Standard-Size

Large Standard-Size

Oversized

Please note that the weight of your product includes the product’s packaging and the item itself. Similarly, the dimensions of the product are based on the package of the product, not the item itself. For example, if a seller listed a non-apparel product with a weight of 15lbs and dimensions of 16” x 12” x 6”, it would be classified as a “Large Standard-Size” product.

Once you have determined what product size tier your product belongs in, you can determine its FBA based on its weight. For example, if your apparel product is classified as a “Large Standard Size” and it has a weight of 2.5 lbs, it would have an FBA fee of $5.95.

FBA Dangerous Goods Fees

One additional factor to consider when calculating your product’s FBA fees is the product’s Fulfillment Classification Status. If your product is potentially classified as a Dangerous Good, Amazon will request that the product undergoes FBA’s Hazmat Review process. This process will require you to submit documentation, generally in the form of a Safety Data Sheet, regarding the physical and chemical characteristics of your product. If Amazon determines that your product is classified as a “Dangerous Goods”, you will have to be admitted into the FBA Dangerous Goods Program to utilize FBA. Currently, this fulfillment program is invite-only, but sellers can also join a waitlist to be admitted. If your Seller Central account has been admitted into the FBA Dangerous Goods Program, you are then able to fulfill your “Dangerous Good” products through Amazon’s fulfillment network. However, there is an additional per unit FBA fee that your product’s shipment will incur. The FBA fees for a “Dangerous Goods” product can be found in the table below:

Remote Fulfillment with FBA Fees

One additional factor to consider when calculating your FBA fees pertains to enrollment in Remote Fulfillment with FBA. Remote Fulfillment is an additional program that allows sellers operating on Amazon.com (USA) to easily list and sell their products in Amazon.ca (Canada) and Amazon.mx (Mexico). There are two primary benefits to this program. The first is that inventory only needs to be in-stock in US fulfillment centers, instead of having inventory stored in all three markets. The second is that when a customer in a foreign market purchases your product, they must pay the import duties on the products. When fulfilling products to additional marketplaces through Remote Fulfillment, each product will have slightly higher FBA fees based on the product's weight and dimensions. Please note that the Remote Fulfillment FBA Fees will only apply to your products sold on Amazon.ca and Amazon.mx, and any of your products sold on Amazon.com will have their standard FBA fees. These fees can be seen in the table below:

How to Calculate Amazon Storage Fees

One additional important factor to consider when using Amazon’s fulfillment network is product storage fees. When inventory levels are properly managed, storage fees may never be incurred, but they can quickly increase when a product has a low sell-through rate and excess inventory stored at fulfillment centers. There are two main forms of storage fees to consider: “monthly inventory storage fees” and “long-term storage fees”.

General Storage Fees

When products are stored in Amazon’s fulfillment centers, they may be charged a monthly inventory storage fee based on the number of cubic feet they occupy. Typically between the 7th and 15th day of the month, Amazon will charge a storage fee to your account based on your average daily storage volume during the prior period. The primary difference for storage fees during different periods throughout the year is for Amazon to minimize the strain on its fulfillment centers during peak consumer-demand periods.

Non-Dangerous Goods Storage Fees

Dangerous Goods Storage Fees

Storage fees can be computed with the following formula:

Storage Fee per Product = Average Daily Units x Cubic Feet per Unit x Storage Rate

For example, if you have a non-dangerous good, standard-size product with a daily average of 50 units in storage during April, and each product has a volume of 0.5 cubic feet, you will pay $18.75 for monthly storage fees sometime between March 7th and March 15th.

Long-Term Storage Fees (LTSF)

Despite fairly low monthly storage fees, your products may begin incurring significant Long-Term Storage Fees if they have been held at Amazon for longer than 365 days. Once a product has surpassed the 365-day inventory age, it will begin being charged a monthly long-term storage fee. Long Term Storage Fees, or commonly referred to as LTSF, cost $6.90 per cubic foot or $0.15 per unit, whichever is greater. LTSF are assessed based on inventory levels on the 15th of each month.

Understanding the age of your inventory is very important for minimizing the impact of LTSF. Sellers can utilize the Inventory Age and Inventory Health reports to determine if they have products that may incur LTSF. If inventory may soon incur LTSF, sellers can either return their inventory through a removal order or use a sale price or advertising to improve their sell-through rate. FBA calculates inventory age on a first-in, first-out (FIFO) basis, meaning that even if you have inventory in-stock nearing a 365+ day age, you can still send in new inventory without prolonging the cost impact of your older inventory.

Conclusion

When selling a product on Amazon, it is important to consider all of the fees associated with utilizing FBA. By understanding Amazon’s variable costs, sellers can appropriately price their products to maximize profit and revenue. If you think your business could benefit from an optimized FBA pricing strategy, please reach out to Goat Consulting to see how we can improve your profitability and minimize your FBA fees.