Amazon released a new market research tool named Product Opportunity Explorer in November 2021. This market research tool is available in beta to Seller Central users. During Amazon Accelerate 2021, Amazon mentioned that they recognized Seller’s needs for the more impactful and actionable search term and competitor research data. The tool is designed to expand on the search term and competitor research that was initially made available in the Brand Analytic tool (Amazon Seach Terms, Repeat Purchase Behaviour, Purchase Behavior). Developing knowledge and understanding about how customers are searching for your products and which products and brands you are competing against in that search is critical to positioning your products for success on Amazon.com. Product Opportunity Explorer’s data is directly provided by Amazon.com. Previous to Product Opportunity Explorer, search terms and competitor research needed to be performed mainly using third-party tools, which contain some risk of the data being incorrectly interpreted or collected. Receiving data directly from Amazon increases the accuracy and reliability of research data. By using Amazon Product Opportunity Explorer you can collect information about search term composition and volume, detailed information about competitor brands, and product positioning. The tools also provides high-level data about categories and niches which provide valuable insights about category and market trends over time. This is especially helpful if you are looking to launch new products. In this post, we will be discussing the different data points that are available in Product Opportunity Explorer. We will also cover some tips for interpreting and collecting research data, and how to apply for access to the tool if you currently do not have access. At this time, all users need to request access. . The tool is still in beta and Amazon plans on rolling the tool out for default Seller Central access once more data is collected from the Beta.

Product Opportunity Explorer Data is Designed Around Niches

When using the Product Opportunity Explorer the first step is to input a search associated with the category or customer need you’d like to research. This could be your product’s name or a use case for it.

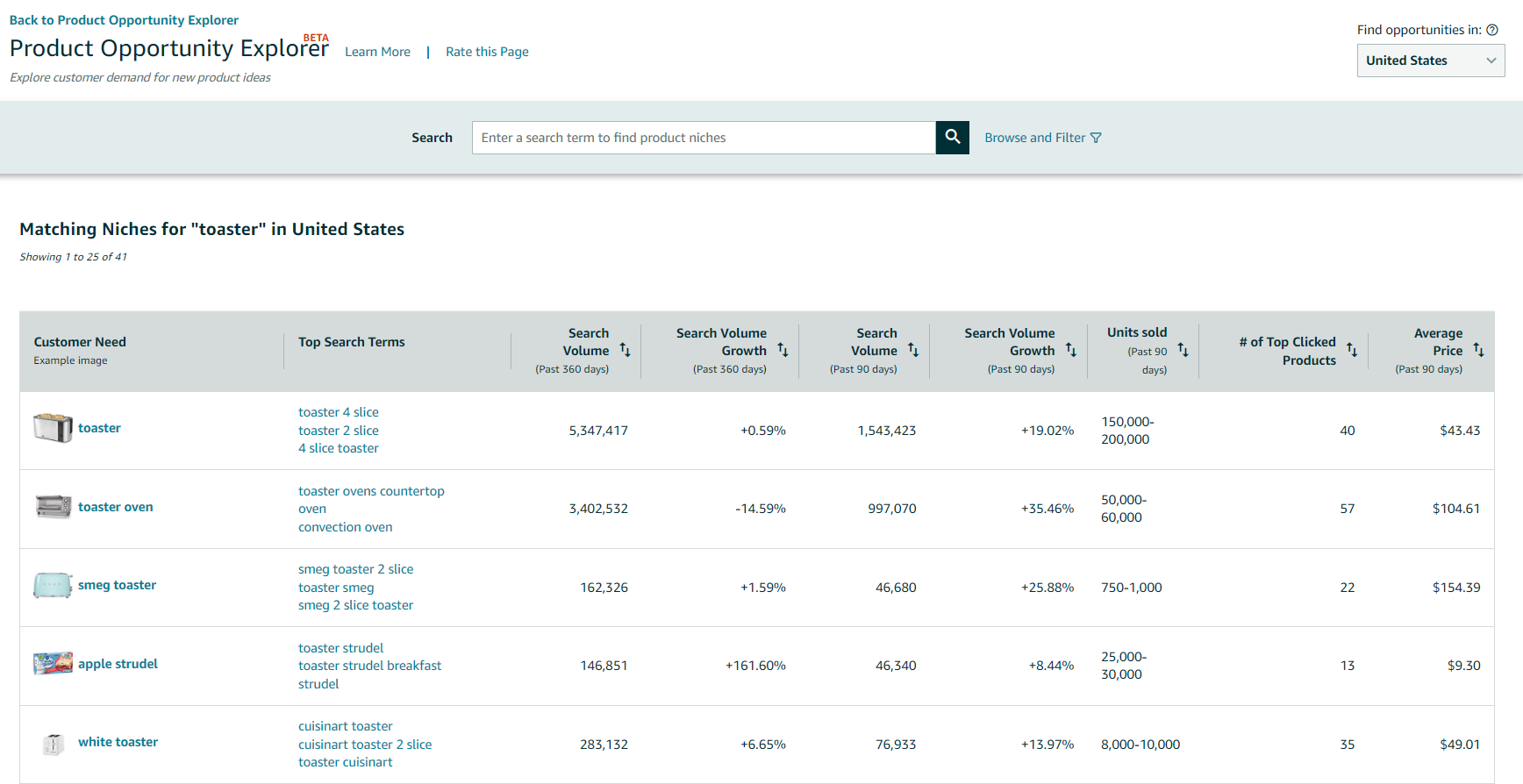

After you input your initial search, the tool will provide a list of niches that Amazon associates with the search. See below for an example of the niches returned for the initial search “Toaster”

In the tool, Amazon organizes search terms and competitor research data by niches. Niches are classified by Amazon as “a collection of customer search terms and products representing a customer need”. If a customer need is not searched frequently enough on Amazon or if the need is difficult to correlate to specific searches and products, a Niche may not be available. In this case, broadening your search or researching a different related customer need will be your best option. You can also filter the niches that are returned for your search by Category, Search Term Trends (90 Days), Long Term Trends (360 Days), Units Sold, Total # of Top Clicked Products, and Price.

Niche Competitor, Search Term and Insight Data

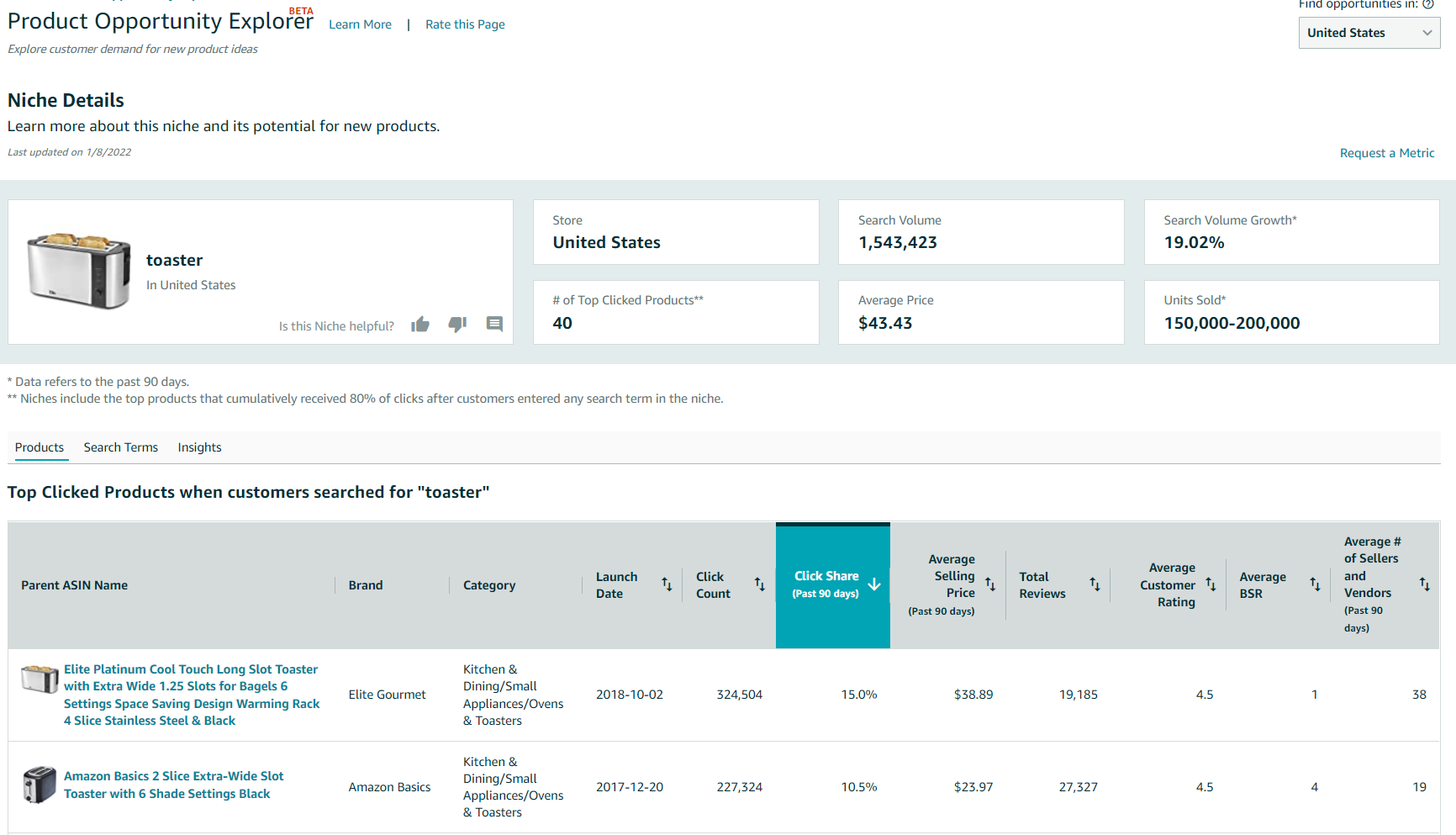

Once you have identified and selected a relevant niche from the provided list. You’ll be taken to the Niche Detail Page. See below for an example of the Niche Detail Page for the Niche: Toaster.

This page contains a dashboard at the top of the page that provides high-level information about the Niche. The # of Top Clicked Products within the Niche is a good indicator of how detailed and accurate the data provided for the Niche may be. The more products that are included in the Niche, the more search and competitor data available. Also, niches with larger amounts of products included have a smaller risk of data being incorrectly skewed or weighted toward a single product.

The Niche Detail Page contains three different tabs. Products, Search Terms, and Insights.

Products Niche Detail

This tab contains SKU/product level competitor research information. The products listed within the tab are the most clicked and most purchased products within the Niche. See below for a list of data points that are available for each product.

Available Data Points

Brand Name

Category

Launch Data

Click Count (90 Days)

Click Share (% of Clicks Received in the Niche)

Average Selling Price

Total Reviews

Review Rating Average

Average BSR/Page Rank

Average # of Sellers and Vendors

Search Terms Niche Detail

This tab contains search term research information. The searches listed within the tab are the most frequent searches within the Niche. See below for a list of data points that are available for each search.

Available Data Points

Search Term

Search Volume in the past 90 days

Search Volume Growth Change (Quarter over Quarter)

Search Volume Growth (Year over Year)

Click Share (Past 90 Days) ie. the % of customer clicks that search captured in the niche.

Search Conversion Rate, the rate at which consumers convert to purchase when the search is inputted.

Top 3 Clicked Products, the 3 top most clicked products for the search.

Insights Niche Detail

This tab contains high-level competitor research information. While the products tab provided product and brand level competitor research information the insights tab provides higher-level information about how the customer need in the Niche is being served by brands and products. See below for a list of data points that are available within the insights table within the tab.

Available Data Points

Total Number of Products in the Niche

% of Products Using Sponsored Products

% of Prime Products

Top 5 Product Click Share

Top 20 Product Click Share

Average BSR

Average Number of Reviews

# of Brands Selling in Niche

Top 5 Brand Click Share

Top 20 Brands Click Share

Average Brand Age in Niche

# of Selling Partners

Average Selling Partner Age in Niche

# of New Products Launched (past 180 days)

# of Successful Launches (past 180 days) (annualized revenue of $50,000.00 or greater)

# of New Products Launched (past 360 days)

# of Successful Launches (past 360 days) (annualized revenue of $50,000.00 or greater)

Average Review Rating

Average OOS rate

Average Listing Quality Score

Tips for Identifying Niches and Interpreting Data

Don’t be over-reliant on niche names to determine relevancy. The name of a niche is a good first step for identifying niches that are relevant to products that you sell. However, Amazon may classify a customer need/niche differently and niche naming is not accurate or transparent one hundred percent of the time. Be sure to review the products and search terms included in the niche as an additional step to detect relevant niches to be further researched.

Find multiple niches that are associated with your product if possible. To gain a full perspective on customer demand, search habits, and your competitive landscape all relevant niches detected should be considered in research. Don’t focus on a single niches data if multiple relevant niches are available. Understanding related niches may also help you determine what products you can expand to next, or what items you should be considered as competition.

If you are having trouble finding a Niche associated with your product try broadening the customer need in your search. For example, looking at the “Toaster” example from this article, if you start your research process with the search “Two Slotted Toaster” and cannot find any relevant Niches, try broadening your initial search to “Toaster”.

Gain an understanding of how Amazon classifies the customer need your brand serves by using your brand name in the initial search. If there is enough significant data, searching your brand name in your initial search will return what niches/customer demand Amazon believes your brand serves. This exercise can be useful in determining gaps in how your want to position your brand vs. how it is positioned in reality.

Copy and paste data from tool pages into excel as a method to export data. There currently is no excel format export option for Product Opportunity Explorer. This feature may be added once the product develops more and is no longer in beta. In its current state, page information can be copied and pasted easily into excel to achieve an excel exported format.

Conclusion

Product Opportunity Explorer provides an unprecedented level of access to search term, competitor, and category trend data. Identifying relevant niches and collecting research data is only the first step in the research process. Correlating collected data with short-term and long-term action related to advertising, merchandising and overall strategy is where this tool provides real unique value. This tool can help improve your current product merchandising, advertising, and positioning, and also can be used to consider new product offerings.

One aspect of Goat Consulting’s services to our clients is to generate short-term and long-term action and strategy driven by market research and best practices. If your brand or business is struggling to determine how this new data translates to action and strategy use the contact us button below to start a conversation.